In a significant move to protect vulnerable property owners, the New York City Department of Finance (DOF) has announced a two-week extension for the 2025 tax lien sale deadline—from May 20 to June 3, 2025. Property owners now have until June 2 to settle their tax debts and avoid the sale of their liens.

“This extension gives New Yorkers more time to take action and get help,” said DOF Commissioner Preston Niblack. “We’re doing everything we can to connect property owners with payment options and support services to help them avoid the lien sale and stay in their homes. If you or someone you know is at risk, now is the time to reach out.”

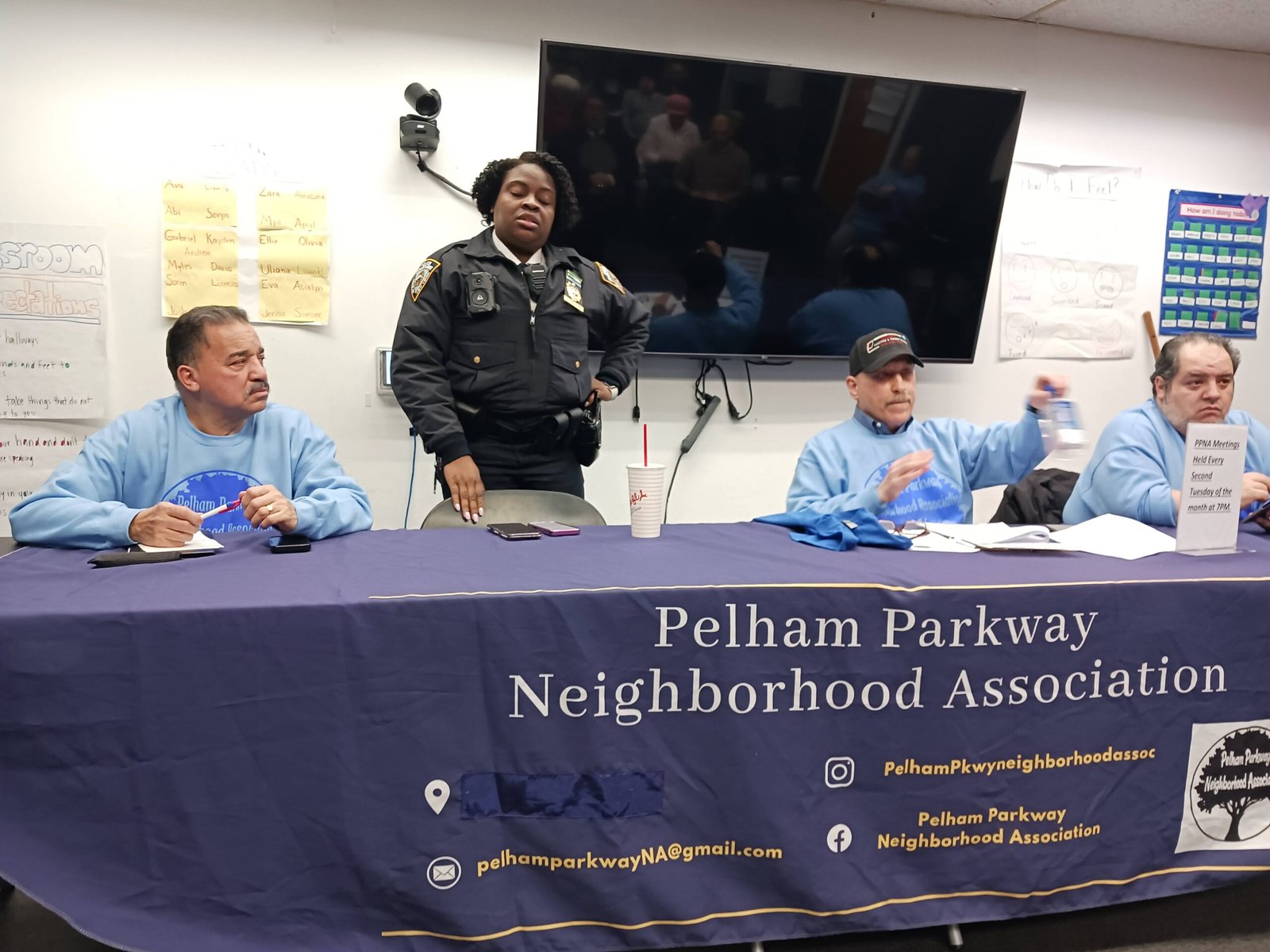

In collaboration with city agencies and nonprofit groups, the Department has rolled out a citywide outreach campaign, focusing on neighborhoods with high numbers of at-risk homeowners. Teams from the Department of Housing Preservation and Development, the Department of Environmental Protection, the Mayor’s Public Engagement Unit (PEU), and the Center for New York City Neighborhoods are mobilized on the ground.

The Mayor’s Public Engagement Unit revealed it has already conducted more than 12,000 outreach attempts, including calls and door-to-door visits. “PEU will continue our outreach efforts to the end of the lien sale list’s new deadline to ensure New Yorkers are aware of their options and have the support they need to get off the list,” the Unit stated.

Property owners have several options to avoid the lien sale, such as paying the balance, enrolling in a payment plan, applying for a property tax exemption or probate, or submitting an Easy Exit application. Resources and guidance are available at www.nyc.gov/liensale.

The extension and outreach are part of a broader reform under the Home Preservation and Debt Resolution Reform Act, signed into law in 2024. The legislation revamped the city’s lien enforcement system, introducing flexible payment plans, expanded eligibility, and new programs like Easy Exit—ensuring more equitable pathways for New Yorkers to resolve debt and remain in their homes.